Case Studies

Discover how our strategic financial solutions have helped businesses like yours achieve success

- Retail

-

Specialty Finance

- Construction

$200M Retailer Does Away With Temporary Staffing

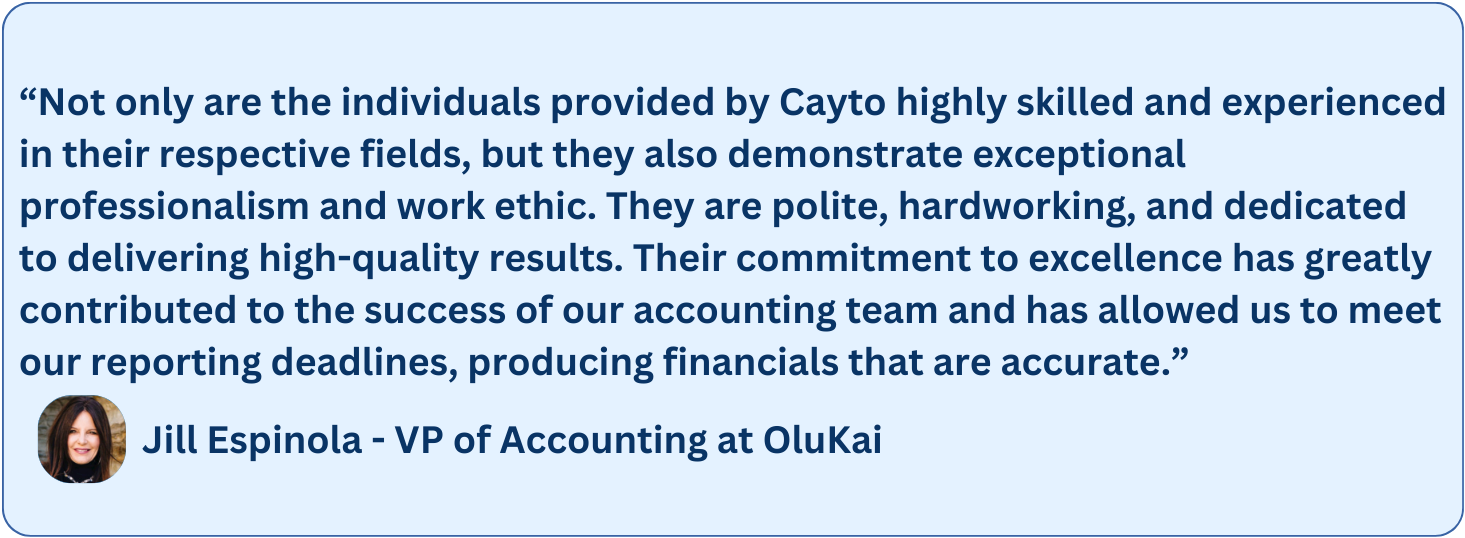

OluKai, turned over eight accounts payable and accounts receivable specialists within one year post-acquisition.

Among other issues, this caused their accounts payable manager to turnover, as they were using a revolving door of temporary staff. Cayto Group initially staffed the company with four specialists across accounts payable and accounts receivable.

Since then, OluKai promoted one of Cayto Group’s specialists to staff accountant, and Cayto Group successfully back-filled the specialist position for the company. Since choosing Cayto Group, not one person in OluKai's accounting department has turned over and they were able to adjust salaries for their in-house accounting team to market rates.

$50M Specialty Financing Company Solves Underwriting Bottleneck

A medium-sized specialty finance company that purchases property easement contracts conducted an internal study which found that its underwriters spent 70% of time compiling data from easement contracts (such as term, payment frequency, payment amount, etc.) and only 30% of time on financial modeling.

Underwriters cost over $100,000 per year and had a maximum throughput of six deals per day. Cayto Group equipped the company with two staff accountants that had a background in real estate contracts and were capable of extracting key information from easement contracts and inputting the key terms into the company’s data warehouse.

This allowed the underwriters to focus exclusively on financial modeling, which is the highest and best use of their time. This increased the throughput of the underwriters to twenty deals per day and created a much more scalable business model.

$300M Concrete Subcontractor Expands Capacity to Handle Construction Accounting

A large concrete subcontractor does 70% of its business between April and October. The company recognizes revenue on a percentage-of-completion method and requires a separate accounting each month for each construction project.

The company’s close was often 4-6 working days longer in peak months than during slower months of the year. The consistent delayed accounting close was causing issues with the company’s lender and bonding partners. The company hired Cayto Group to staff three Chartered Management Accountants with a background in construction.

This allowed the company to affordably reduce the time to complete the company’s monthly accounting close by nearly 40% due to added capacity within its accounting department.